With a global pandemic comes record job loss, financial uncertainty and of course, market volatility. In a time where Statistics Canada has reported 12.5% of paid workers in Canada have been laid off since February 2020, reaping in profit could be seen as immoral. Although a number of Canadians are in an uncertain financial position, it is still possible to make money in this time through taking advantage of the volatility the market has brought forth.

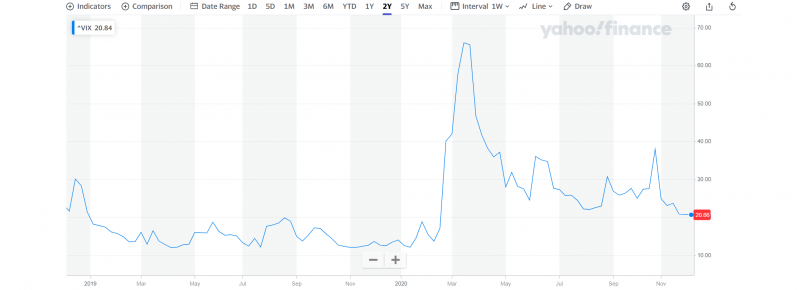

Last year, according to the VIX (Volatility Index), there was a 78% maximum change from the lowest to highest value, compared to a 571% change in 2020 thus far. This change does not come without hardship for the people; so is it unethical to use the volatility to your advantage?

The term “ethical” is one that comes with much debate, however it is, ultimately, subjective. When it comes to personal investment strategy, some may say we have a moral obligation to invest ethically.

ADVERTISEMENT |

Since March, the S&P 500 has rallied by 65%, creating a substantial financial divide between the state of the top companies and their investors versus the people. The health of large corporations compared to that of small companies throughout the pandemic has been unparalleled; thus creating even larger monopolies.

So, is it unethical to invest in DOW 30 companies rather than supporting smaller publicly traded companies? All in all, it is up to you and your personal ethical standpoint to invest in what you are comfortable with. However, breaking the market down by sector is beneficial to decide what you are comfortable investing in at this time. The following list comprises three of the most rewarding, yet controversial sectors throughout the pandemic.

Travel & Tourism:

Defining the travel & tourism sector can be difficult as it incorporates hotels, transportation, attractions, travel companies and more, but it is not difficult to say that this industry has been hit hard throughout the pandemic. There has been plenty of room for growth in this industry and they still have a far way to go in order to reach their previous highs, but this opportunity is accompanied by widespread layoffs.

Real Estate & Development:

In a time where over 12% of Canadians had been laid off since February 2020, and paying rent or mortgage payments has become increasingly difficult, investing in this sector may be accompanied by some feelings of guilt.

ADVERTISEMENT |

The development of new neighbourhoods and condo buildings at this time can lead to profit once the demand increases to previous levels, however investing in real estate when many people can hardly afford rent could be interrupted as immoral.

Health Care:

The race to release a successful COVID-19 vaccination, COVID related treatment and the pandemic as a whole has been the source of increased market volatility this year, according to the CFA Institute. The ability to distribute a vaccine throughout the country or the source of the vaccine can bring forth personal ethical questions due to the fact it has not yet been guaranteed everyone will have access.

Aside from the vaccine, investing in an industry profiting off of the death and sickness of thousands of people may not be something each investor is comfortable with.

Ultimately your moral compass will guide you in the right direction. However, it is important to ask yourself questions that will spark useful analysis of your investment opportunities in 2020.

—

*Please note this is NOT the list of GISC sectors

ADVERTISEMENT |

*This is not intended to be a guide for your investment strategy but is instead intended to spark conversation regarding ethics in the 2020 world of investing.