If stopping at Tim Hortons is a part of your daily routine, then we’ve got some news for you. You may need to sit down or have someone hold your coffee in preparation for this news, Tim Hortons is launching its very own credit card. Yes, that’s right! The new Tims card will allow you to reap the rewards points faster and redeem more free coffee, drinks and food items. Keep reading to find out more about the credit card.

About the Tim Hortons credit card

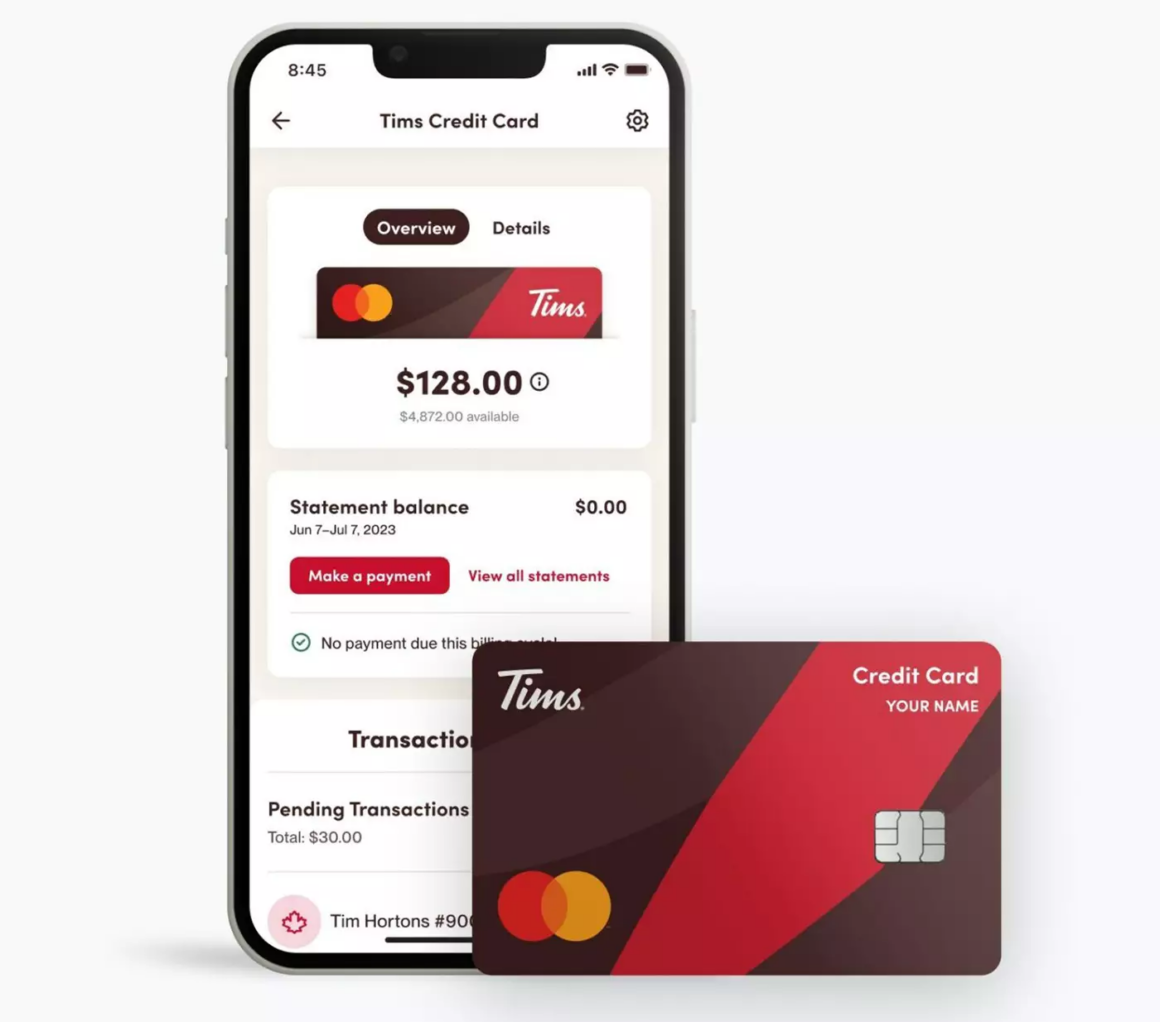

On Wednesday, June 7, Tim Hortons announced their plans to launch their own credit card in an effort to help customers earn more Tims Rewards Points. The card is launching through Tims Financial, the newest division of the beloved brand, within the next few months. Although the release date has not been announced, you can expect to start enjoying the benefits of the credit card sometime later this year. The credit card will be a Mastercard with no annual fee and powered by Neo Financial.

“With almost five million Canadians actively using our Tim Hortons app every month, it became obvious that we could offer our most loyal guests a way to earn Tims Rewards Points even faster,” said Markus Sturm, Senior Vice President of Digital, Loyalty and Consumer Goods.

ADVERTISEMENT |

How it works

You’ll even be able to use the credit card directly through the Tim Hortons app we all know and love. Not only can you check your balance from the app but you can also apply and be approved through the app. It’ll be as easy as ordering a double-double!

You can experience rewards everywhere you shop, earning up to five points per dollar on qualifying gas, grocery, and transit transactions. Enjoy an impressive 15 points per dollar when you utilize the card for eligible purchases at Tim Hortons and scan for Tims Rewards. It’s important to note however that Costco and Walmart are excluded from gas and grocery points.

If you’re new to credit cards, don’t worry! Tims announced they will also be offering a version to Canadian residents with limited or no credit history so they can earn points and build credit at the same time.

“We believe this is an exciting new financial option for millions of Canadians, including newcomers and students who are looking to build their credit history,” added Sturm.

ADVERTISEMENT |

Although the Tims credit card isn’t available yet, you can sign up for the waitlist here.