With strong growth and an average condo selling price of $616,591, Toronto real estate had a whopping 10.4% year-over-year price raise by the last quarter of 2019. Before the COVID-19 crisis, the Toronto real estate market continued to heat up and was considered one of the hottest real estate markets in Canada, with a benchmark price of $846,100 in February and a 45% rise in home sales.

In the face of this pandemic, key stakeholders are not quite sure what the effect of the ensuing health and economic crisis would be on the complex Toronto real estate market.

This article explores how COVID-19 impacts both residential and commercial real estate markets in Toronto, with the key drivers being: Immigration, (Un)Employment/small businesses, Mortgage Rates and Market Uncertainty.

ADVERTISEMENT |

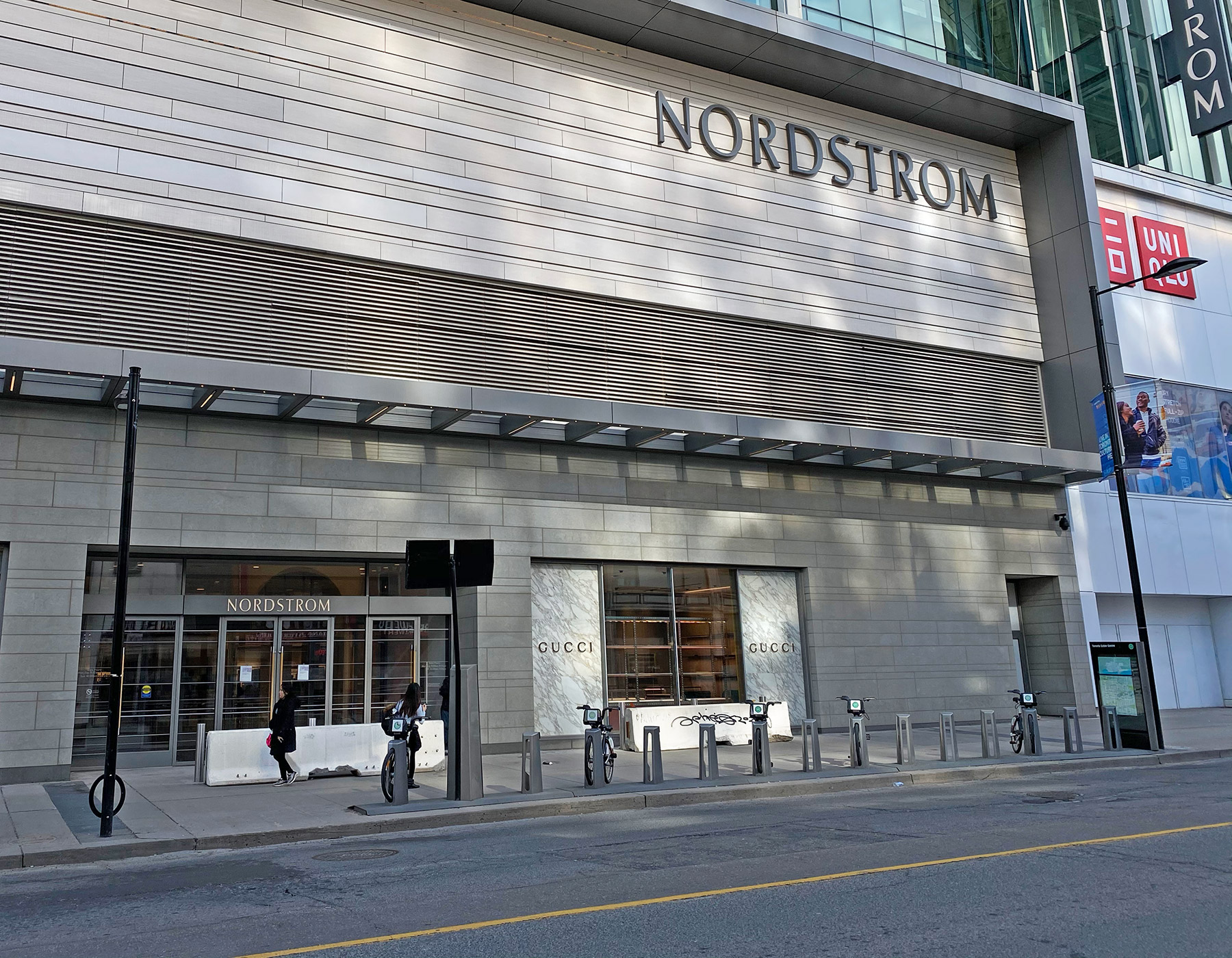

How Toronto’s Commercial Real Estate Market is Impacted by COVID-19

Financial pressure on small businesses : The commercial real estate market has experts worried. If the lockdown exceeds a 2-month period, which is a very probable case, a lot of businesses are likely to fold up, even with the government wage subsidy and help that CMHC is providing to the real estate market. Coupled with the fact that businesses are strongly integrating the work from home policy into their official work templates and may have to let go of some employees, it is projected that the demand for commercial real estate will go down.

Immigration: Ontario accounted for about 46% of the over 300,000 immigrants into Canada in 2019, with most newcomers moving into the Greater Toronto Area. The ripple effect of COVID-19 protective measures like border closure would be a significant decline in the number of immigrants into Canada this year. This will definitely have an adverse impact on the commercial real estate market in Toronto, which used to receive a boost from the immigrant influx who open or buy businesses when they arrive.

Uncertainty: Commercial realty had a 3.7% rise in sales during the 2019 year-over-year review which was lower than the residential market. In these uncertain times however, it is predicted that sales in the commercial real estate market would reduce significantly since while many small businesses may shut down not many new businesses would start until they become sure about the future.

ADVERTISEMENT |

How Toronto’s Residential Real Estate Market is Impacted by COVID-19

Unemployment: A key driver of the residential real estate market in Toronto is the strong job market and the flow of immigrants. Already, Canada has a 7.8% unemployment rate by March 2020, with the economy shedding over 1 million jobs. If unemployment rates rise up to 20% as predicted by top economists, demand for residential properties will significantly drop as many wouldn’t be able to afford to purchase them. However, the Canada mortgage deferral program is helping many homeowners to not default on their mortgage payments. At the same time, it is easy to see the impact of accumulation of mortgage interest by using a mortgage payments calculator for almost 600,000 Canadians who either defer or skip their mortgage payments. Regardless, the Toronto job market is relatively strong, and may be less affected in comparison to the other smaller Canadian cities.

Immigration: Over 139,000 immigrants gained entry into Ontario in 2019. The predictable drop in immigration due to the pandemic would have a significant impact on the residential real estate market, as immigration is a key driver of hot real estate in Toronto. If the number of immigrants reduces by even half, the effect of a slowed down population growth on the market would be telling!

Uncertainty: Till the pandemic runs its course, a sense of uncertainty remains. This will lead to a decrease in the number of transactions- regardless of home prices- as key market players i.e. sellers and buyers wait for more certain times. Uncertainty could perhaps cause a reversal of the 12.3% rise in year-over-year sales of residential transactions witnessed in 2019.

Mortgage Rate: while the mortgage rates in Canada have dropped, the impact is projected to be minimal since the rates have been low for a long time and the impact of the mortgage rate on affordability is much lower than the income amount. Beside this the current economic uncertainty may make the lenders more conservative about giving mortgage to people with unsteady incomes such as self-employed.

ADVERTISEMENT |

Conclusion

The major factors that would affect Toronto’s real estate market- both commercial and residential- are unemployment, struggle of small businesses, immigration and economic uncertainty. Commercial real estate is estimated to become lower priced and to have a much reduced number of transactions while for residential real estate, slightly lower prices in the short term with lower number of transactions are predicted.

Submission by: Hayden Smith

ADVERTISEMENT |